African nations continue to lag global uptake in networked readiness but offer glimmers of progress

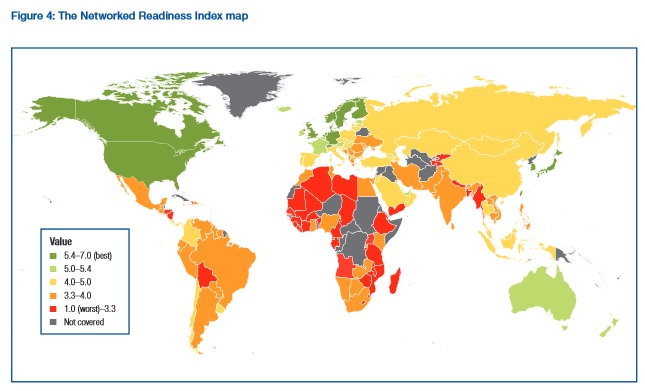

The Global Information Technology Report presents data by variable for 148 economies (up from 144 last year). Of special interest is the Networked Readiness Index (NRI), which offers an overview of the current state of ICT readiness in the world. For at least the past three years, the report has found that although African nations sorely lag the global mean of networked readiness, many nations show a glimmer of hope across various sub-categories.

As is typical with this type of report, there are many variables that affect a nation’s ranking. For one, African island nations (Mauritius, Seychelles, Cape Verde) tend to rank relatively well on ICT infrastructure and ICT usage. Logistically, is simply easier to cover a small geographic area like an island with mobile coverage and a small population is easier to manage than a huge one like Nigeria, for example. Large nations like South Africa and Kenya, in turn, tend to be slower to adapt ICT policy, connect extremely diverse populations, and fund large-scale infrastructure projects. Another caveat is outdated data; multiple sub-pillars like internet cost and mobile broadband usage rely on data that is now two years old and is borderline inaccurate (ie. there is indeed mobile broadband in places like Cote d’Ivoire even though this report says otherwise).

Still, as we often repeat, the trends and a handful of statistics are worth actual consideration.

SSA summary:

Sub-Saharan Africa slowly continues to develop its ICT infrastructure, especially by expanding the share of the population covered by, and having access to, mobile telephony and by expanding the number of Internet users, which in some countries—such as South Africa—has almost doubled. These improvements have led to many important innovations that provide more and better services that were previously unavailable, such as financial services. Notwithstanding this progress, the region overall continues to suffer from a relatively poor ICT infrastructure, which remains costly to access, although some notable exceptions exist. More importantly, severe weaknesses persist in the region’s business and innovation ecosystems, which result in very low positive economic and social impacts. Addressing these weaknesses, not only by developing a more solid ICT infrastructure but also by improving the framework conditions for innovation and entrepreneurship, will be crucial to avoid the emergence of a new digital divide that will be evident in a disparity of the economic and social impacts associated with what has been called the digital revolution.”

Mauritius (48): Better (affordable) ICT infrastructure and skills base. Higher level of individual usage. Economic impacts of ICT are still low and a minority of the population uses the Internet.

South Africa (70): Expensive infrastructure but relatively strong business engagement with ICT. The government does a poor job embracing ICTs and social impacts of ICT are low.

Rwanda (85): Some, but little progress as ICT infrastructure is still lacking and is expensive. Government vision for ICT is among the best in the world but ICT is still not widely adopted and cannot be leveraged to boost the economy (yet).

Kenya (92): A strong government vision for ICT (like Rwanda’s) exists despite low uptake among population. The business environment does not fully benefit from ICTs.

Zambia (110), Uganda (115), Tanzania (125): East African nations lag in terms of ICT infrastructure and promotion of ICT uptake but still lead West Africa which sees Senegal (113), Gabon (128), Cameroon (131).

Tunisia (87), Egypt (91), Morocco (99), Algeria (129): All North African nations except for Algeria fell in the annual rankings, with Egypt and Morocco falling by 11 and 10 positions, respectively. ICT uptake has increased in all nations, just more slowly than in others. Egypt has relatively affordable access to ICT and the government utilizes ICT on par with others. Low innovation capacity by Egyptian companies and a weak regulatory environment hurt the rankings, however. In Morocco, more than half of the population uses the internet, but skills are lacking and the government is yet to fully embrace ICTs.

African nations hold down 20 of the bottom 24 positions. They range from 125th to 148th position and (according to the report) severely lack ICT conditions and ICT impacts.

A visual of the Networked Readiness Index. {WEF}

Year-over-year NRI rank change:

Two years ago, nearly every African nation dropped in networked readiness. Last year, twelve African nations saw a relative improvement, but nineteen remained unchanged or dropped in the rankings. Once again a similar trend was found for Sub-Saharan Africa and North Africa. Of the 40 such countries in the report, only fourteen improved, remained unchanged, or were new to the Network Readiness Index; the other 26 dropped in position. The indication is that ICT readiness in other global regions continues to outpace that in Africa.

Notable changes in global NRI position for 2013-2014 (greater than 7 positions movement):

- Seychelles (up from 79 to 66)

- Cape Verde (down from 81 to 89)

- Egypt (down from 80 to 91)

- Morocco (down from 89 to 99)

- The Gambia (down from 98 to 107)

- Liberia (down from 97 to 121)

- Swaziland (up from 136 to 126)

- Sierra Leone (up from 143 to 134)

- Benin (down from 123 to 135)

Sub-Pillars:

- 1.02. Laws relating to ICT – South Africa, Rwanda and Mauritius are well ahead of the global mean.

- 1.06. Intellectual property protection – South Africa and Rwanda are well above the global mean.

- 2.02. Venture capital availability – Above average in South Africa, Rwanda, Seychelles, Tunisia, Mauritius, Kenya, and Egypt.

- 3.03. International Internet bandwidth per user – Very low in SSA, under 1% in Ghana, Cameroon, Nigeria, Chad, Madagascar, Angola. Highest is 23.7 kb/s in Kenya, followed by 18.1 kb/s in South Africa.

- 3.05. Accessibility of digital content – Mauritius is highest in Africa (and only African country above global mean) at 76th.

- 4.02. Fixed broadband Internet tariffs (monthly sub. charge, PPP $, 2012) – Guinea is again at the bottom and is joined by The Gambia not far behind. In many cases, costs have lowered since last year (~$100 for Swaziland and Malawi compared with over $1,400 last year). Guinea’s ridiculous $2,050 charge is also off the chart though it is down by $18 year-over-year. Even The Gambia’s $987 charge (slightly higher this year) is more than two times that of Rwanda which lies only two places higher in the ranking. Tunisia is in the #7 spot with only $14.42/month. Egypt, Morocco, and Algeria are also in the $21 and under range (top 30). Also notable is Zimbabwe in the 32 position and Chad in the 52nd position ($26). In general, SSA is in the $40-$100 range which ranks 100th-140th globally.

- 4.03. Internet and telephony sectors competition index – Ethiopia and Libya are again tied for least competition in the world. Swaziland still isn’t far behind. Nine African nations have a high level of competition.

- 6.02. Internet users – Morocco again leads Africa with 55% (57th place), which is 4% higher than last year, but four places lower. All of SSA is in the bottom half globally, led by South Africa at 41% and Kenya at 32%.

- 6.03. Households with a personal computer – Last place Burundi at 0.1%. Most of SSA is in the single digits though South Africa stands at 24%.

- 6.04. Households with Internet access – Burundi is in last place at 0.1%. Kenya, Swaziland, and Ghana are in the 10-12% range.

- 6.05. Fixed broadband Internet subscriptions – 12 African nations have below 0.1 subscription per 100 population (a slight improvement on last year). Only Mauritius is above 5%.

- 6.06. Mobile broadband Internet subscriptions – Ghana (48th with 34% – up from 23% in 2011), Namibia (50th with 33% – up from 21% in 2011), Zimbabwe (57th with 28%).

- 6.07. Use of virtual social networks – Tunisia (40th), Egypt (50th), and Mauritius (69th) are above the global mean. Burundi, Chad, and Ethiopia again lag other nations.

- 7.04. Extent of business Internet use – Highest in South Africa (30th – up from 46th two years ago), Namibia (50th), Kenya (57th).

- 8.01. Government prioritization of ICT – Rwanda ranks 5th in the world after sitting in 10th place last year. The Gambia (23rd) and Kenya (26th) also lead on a global level. Libya, Egypt, Angola, Mauritania, and Lesotho are near the bottom.

- 8.02. Government Online Service Index – Egypt (42nd), is alone among African nations in the upper half. Guinea and Libya are again in last place with an index of 0.00.

Source: The Global Information Technology Report 2013-2014. © 2014 World Economic Forum {http://reports.weforum.org/global-information-technology-report-2014/}

Twitter

Twitter Facebook

Facebook Pinterest

Pinterest