Dominant African mobile operators usually offer cheapest domestic mobile product

Across Africa, telecom operators have started bundling voice, SMS, and data services to maintain revenues in light of the increasing popularity of VoIP and mobile messaging services. A Research ICT Africa Policy Brief, predominantly focused on South Africa, examines how mobile operators are developing new pricing strategies to retain subscribers.

There has been a trend in African telcoms markets towards data offerings as better infrastructure and devices become available. The demand for data is increasing and operators must keep prices reasonable to grow their subscriber base in ever-competitive markets. In recent months, mobile operators at least eight African countries have introduced prepaid bundle services. Bundled prepaid packages can now be found in:

- Angola: Movicel

- Cameroon: Orange

- Egypt: Mobinil, Etisalat, Vodafone

- Tanzania: Airtel, Benson, Tigo, Vodafone, ZTL

- Namibia: TN Mobile, MTC

- Kenya: Orange, Yu, Airtel

- South Africa: MTN, Cell C

However, in many cases the bundles are more expensive than the cheapest product in the country. In Tanzania, Cameroon, and Namibia, the new bundle tariffs are actually the cheapest mobile prepaid product.

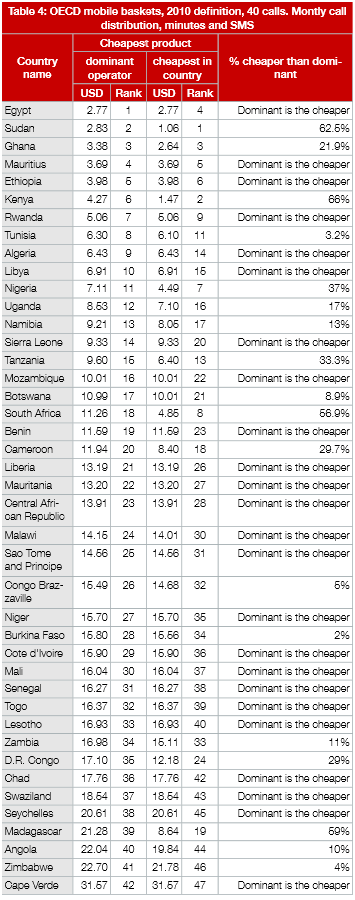

It comes as no surprise that Research ICT Africa finds the dominant operator to usually offer the cheapest product. Many exceptions exist among the 42 mobile baskets in question (just look at Kenya and South Africa), but it makes sense that the dominant operator would have the scale needed to offer lower mobile tariffs.

Notably, prepaid mobile voice/SMS prices continued to decline in South Africa (to USD4.85 for the cheapest product in Q1 2014) but still are more expensive than the cheapest in Africa (Vodafone Egypt and Zain Sudan have options from the dominant operator for around USD2.80). Moreover, it is interesting to note that a non-dominant (perhaps the second largest?) mobile operator in Sudan, Kenya, South Africa, and Madagascar offers an approximately 60% cheaper equivalent product than the dominant operator. Such a vast price disparity is surprising, but pricing doesn’t take into account factors like network coverage and reliability.

The following table summarizes the cheapest mobile product in nearly every African nation as of Q1 2014. Dominant and cheapest operator are given as well. These prices are not the end-all, but they attempt to allow a cross-country comparison of mobile prices. Above all, notice the extreme variance in pricing between the top and bottom of the list (from USD2.77 in Egypt to USD31.57 in Cape Verde).

Source: “Shift from just-voice services: African markets gearing for internet,” Research ICT Africa, April 2014.

Twitter

Twitter Facebook

Facebook Pinterest

Pinterest

[…] comes as no surprise that Research ICT Africa finds the dominant mobile operator to usually offer the cheapest product. Many exceptions exist among the 42 mobile baskets in question (just look at Kenya and South […]