Africa region highlights from ‘The Mobile Economy 2013’ report

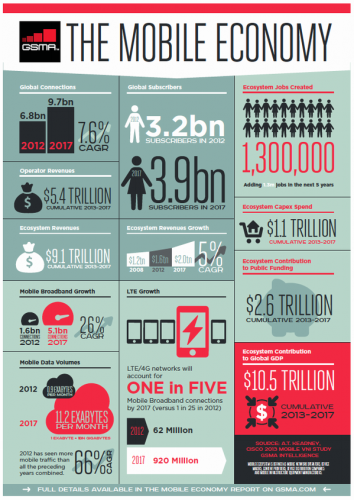

Very recently, the GSMA, an association of nearly 800 mobile operators spanning more than 220 countries, released a current overview of the mobile industry. In particular, “The Mobile Economy 2013” looks at the socio-economic contribution of mobile, the growth of data, and what steps can be taken to spur greater investment in mobile communication. Most of the report speaks to general global trends, but the Africa region earned a fair share of attention due to the rapid adoption of mobile.

A slew of numbers accompany the report (we’ll get to those in a minute), but interesting is the near-term expectation of little change in the number of people employed in the African mobile ecosystem. That’s right: mobile ecosystem employment levels are expected to remain at 2012 levels for the next five or so years. This is because the rise of distribution channels drove job growth in the past. The problem now is that these channels are labor-intensive but are not high in productivity. Consequently, we can expect productivity to offset customer growth over the next few years. (Of course, other sectors directly tied to content creation will experience employment growth.)

Two other findings stand out among those relating to Africa:

- The release of an additional 250 MHz of mobile spectrum in Sub-Saharan Africa in 2014 would mean US $36 billion in benefits by 2020. If this spectrum is properly allocated to mobile communications, another 27 million jobs would potentially be created by 2025. These are huge numbers!

- Africa’s contribution toward global mobile ecosystem revenues is growing at 7% annually. No region is experiencing such growth. Even then, Africa’s contribution of mobile revenues to the global ecosystem will not reflect its global population share any time soon.

Additional Africa-region facts from the 100-page report deal with common metrics such as penetration rates and revenue per user. There are no surprises here, but the rapid mobile adoption is made for those less in the know about African mobile trends.

SIM Penetration:

- Sub-50% in 2008

- 73% in 2012

- 97% in 2017

- 5% in Eritrea

- 8% 3G penetration rate

- 96% of African mobile plans are pre-paid, the most of any region by far

Mobile broadband:

- In 2012, nine-tenths of total broadband connections were mobile broadband connections

- Mobile data traffic is expected to grow by 79% annually from 2012-2017

Average Revenue Per User (ARPU) has declined by 10% annually from 2008-2012:

- US $12.20 in 2008

- US $7.90 in 2012

- Africa is still the lowest revenue per user global region

Average Revenue Per Subscriber (excludes multi-SIM effects) has declined by 10% annually from 2008-2012:

- US $18.60 in 2008

- US $14.80 in 2012

- Africa is the 2nd lowest revenue per user global region (behind former Soviet states)

Note: The Africa region is defined as 25 nations – Algeria, Angola, Benin, Burkina Faso, Cameroon, Democratic Republic of the Congo, Côte d’Ivoire, Egypt, Ethiopia, Ghana, Kenya, Libya, Madagascar, Mali, Morocco, Mozambique, Nigeria, Senegal, South Africa, Sudan, Tanzania, Tunisia, Uganda, Zambia, Zimbabwe.

Source: “The Mobile Economy 2013,” GSMA, A.T. Kearney, 2013. http://gsmamobileeconomy.com.

Twitter

Twitter Facebook

Facebook Pinterest

Pinterest