30+ key mobile trends found in Sub-Saharan Africa (plus visuals)

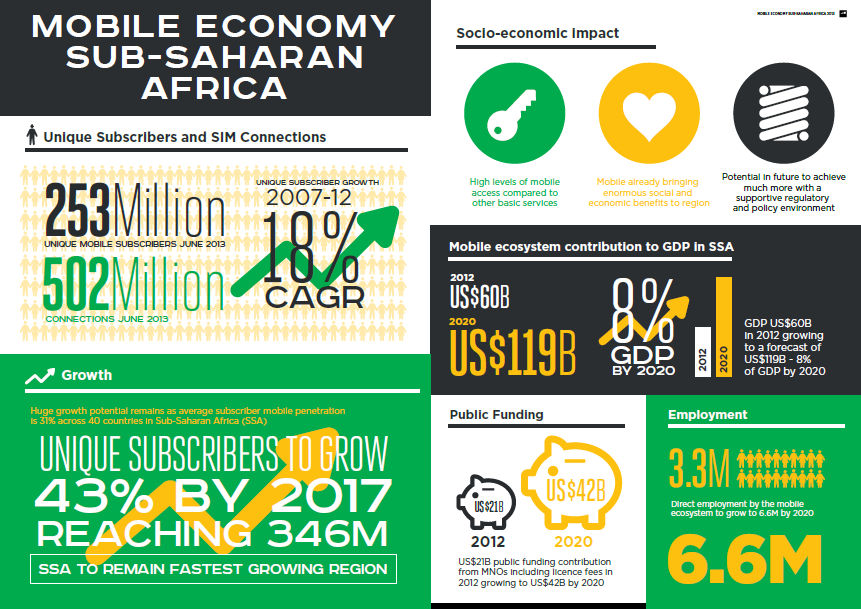

A recent report by GSMA touts recent gains by Sub-Saharan Africa’s mobile ecosystem but is quick to mention how the biggest social impact of mobile in Africa still lies ahead. The majority of those living in SSA do not yet have a mobile subscription and mobile data usage is in its infancy. The mobile industry is a hefty contributor to regional GDP (adding 6% to SSA’s economy), yet governments are remiss to invest in long term measures that would support development of mobile adoption.

After going through the 90-page report, we’ve pulled some key talking points on mobile engagement within Sub-Saharan Africa:

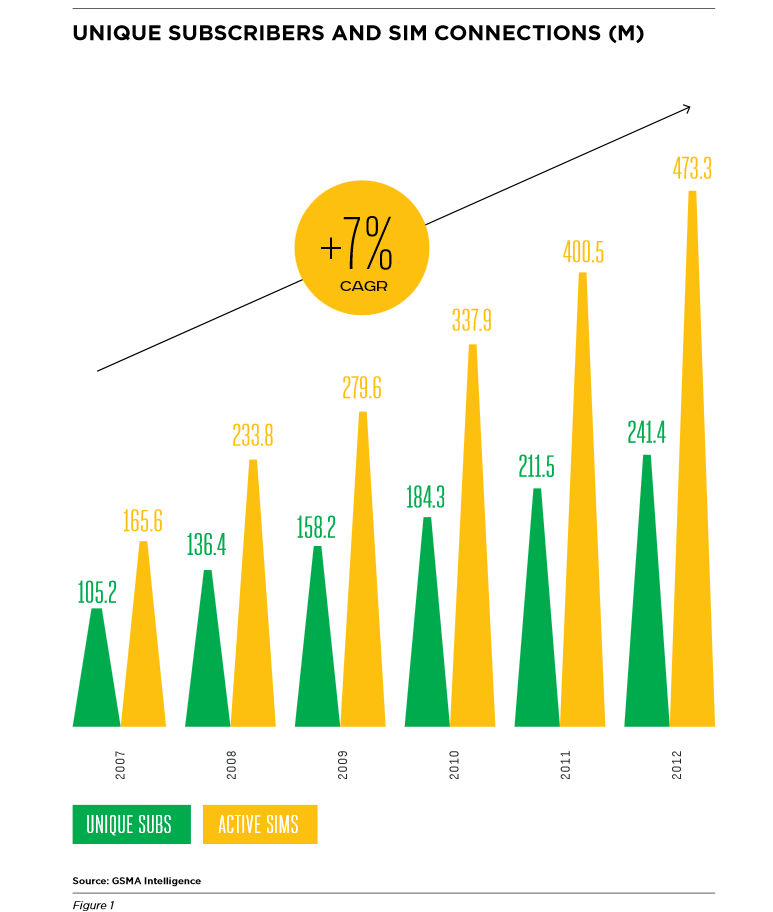

- 253 million unique mobile subscribers as of June 2013 will become 346 unique mobile subscribers by 2017

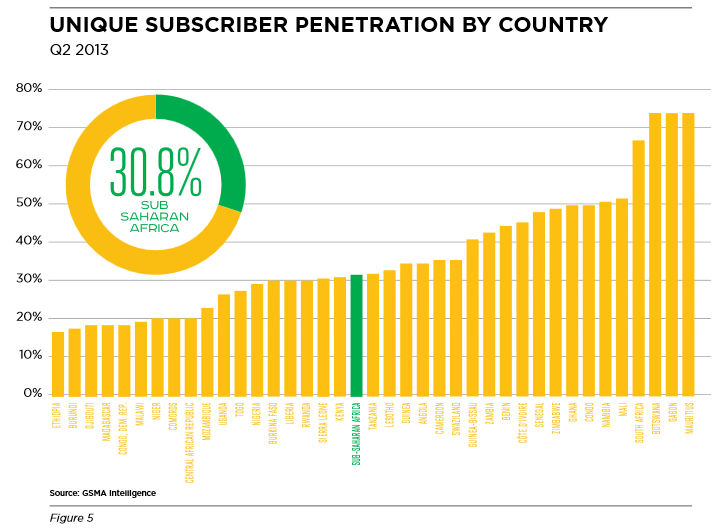

- Average subscriber mobile penetration is 31% across 40 countries (global average is 50%, Europe is 80%)

- Debate about growth rates should be focused on subscriber trends rather than SIM trends (Nigeria, Senegal, and Ghana average two SIMs per subscriber)

- The value of the mobile ecosystem will double from 2012 to 2020 (US$60B to US$119B)

- Mobile’s contribution to GDP will grow from 6% in 2012 to 8% by 2020

- Direct employment by the mobile ecosystem will double from 3.3 million to 6.6 million by 2020

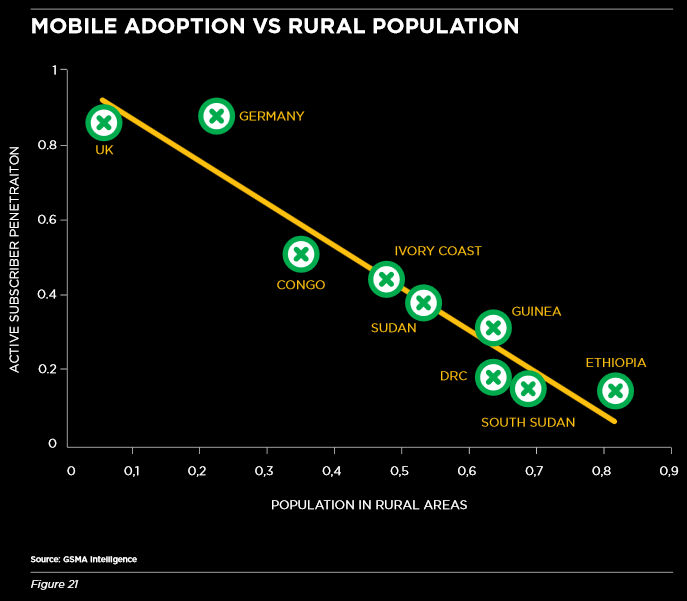

- Incremental subscriber growth will come almost entirely from rural and lower income populations, reinforcing the need to further improve the affordability of mobile services and to extend network coverage

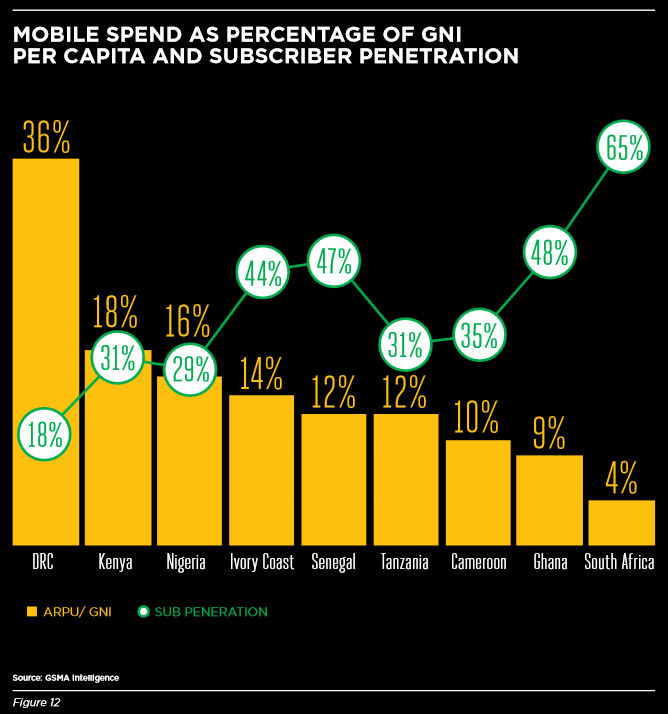

- Mobile users send an average of 15% of their income on mobile services

- Unique subscriber penetration rates go from 70% in Botswana, Mauritius, and Gabon to 17% in Ethiopia

- Around a third of the total subscriber base can be found in South Africa and Nigeria

- In East Africa, although 75% of the population had mobile coverage, 96% of the uncovered population was located in rural areas

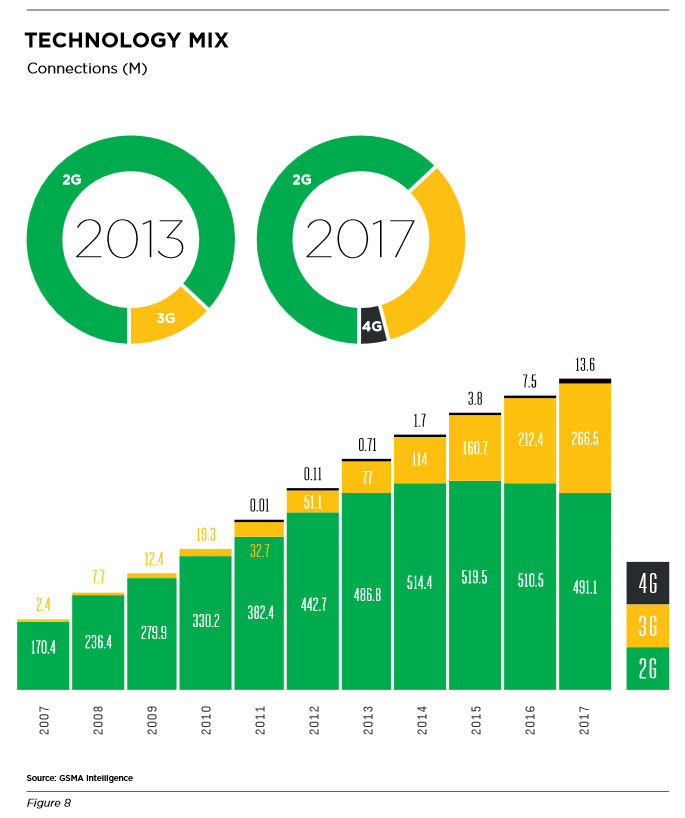

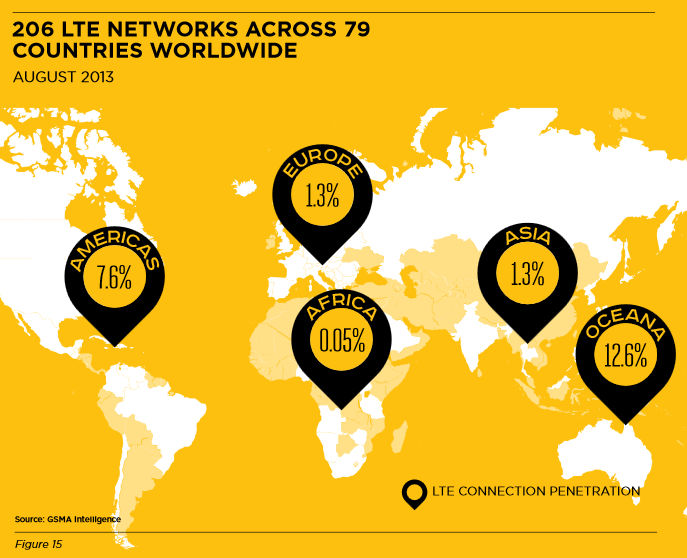

- 86% of connections at the end of 2013 will be 2G, just over 13% will be 3G, and 0.1% will be 4G

- In 2017, 2% of mobile connections will be 4G

- Nine countries in the region have commercial LTE networks in operation as of August 2013

- 3G penetration rates range from 5% in Senegal to 39% in South Africa

- At the end of 2012 smartphone penetration was 4% but will approach 20% by 2017

- Mobile broadband is accessed by less than 1% of the population in Cameroon, Niger, and Ethiopia (30% in South Africa)

- Data speeds average 63kbps but should grow to 588kbps by 2017

- Low income levels and illiteracy will force many to continue to use feature phones on prepaid plans

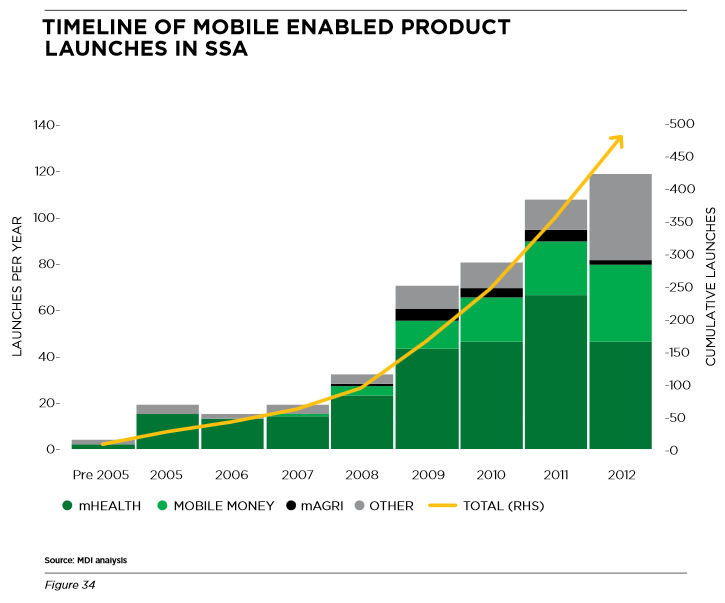

- Mobile services like mobile money and mHealth are a good example of how stakeholders can address key social issues

- There were over 110 active mobile money initiatives in 2013 (and 57 million registered mobile money users who represent 70% of the world’s mobile money user base)

- There are nearly 250 mobile health services in operation

- African women are 23% less likely than men to own a mobile phone (and 43% less likely to use the internet)

- Spectrum management and mobile taxation are key regulatory issues – but excessive regulation can hurt innovation, competition, and consumer well-being

- A robust license renewal process with fair costs is a must

- Twenty countries had customs duties on mobile handset imports as of 2011 (Niger applied a 47% custom duty)

- In Gabon, more than one-third of the cost of mobile ownership was attributed to taxes (2011)

- At least 18 nations have Universal Service Funds to incentivize mobile operators to extend services to underserved areas

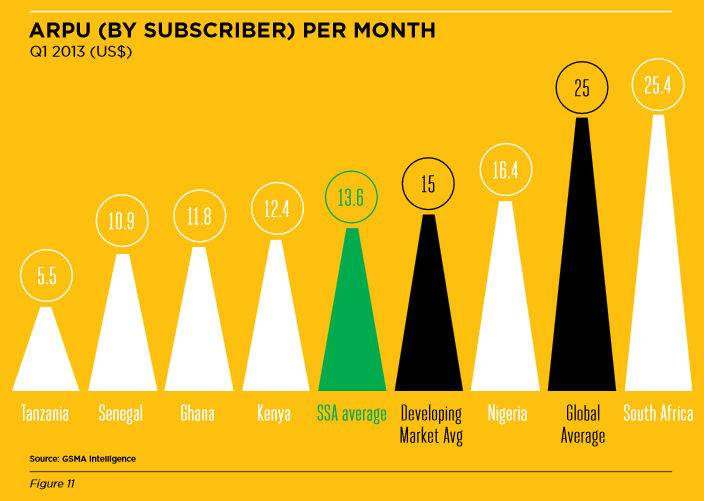

- Average revenue per subscriber (ARPU) in Q1 2013 was US$14 which is on par with other developing markets

- ARPU ranges from US$5.50 in Tanzania to US$25 in South Africa

- In DR Congo, mobile spend equate to 36% of gross national income per capita (4% in South Africa)

- In summary, three challenges preventing medium-term potential of the SSA mobile sector are: the need to make mobile services affordable to low income markets, the need to incentivize mobile network build-outs, and the need to create conditions that allow mobile broadband uptake

The report is also full of great visuals. A few especially stood out (click to enlarge):

Source: “Sub-Saharan Africa Mobile Economy 2013,” GSMA Intelligence, November 2013. http://www.gsmamobileeconomyafrica.com

Twitter

Twitter Facebook

Facebook Pinterest

Pinterest