Is African broadband data worth it?

A Research ICT Africa policy brief from June 2014 asks the question: “Is broadband data worth the money?” The answer depends on where you live.

African mobile networks are expanding but most are constrained by limited broadband spectrum. Regulators often fail to assign LTE spectrum, for example, leaving operators to use existing frequencies that are sub-optimal for LTE speeds. Additional policies limit the viability of LTE networks.

Some operators do provide both affordable prices and strong average download speeds. Safaricom in Kenya and Vodacom in South Africa were touted for this ability.

More operators are offering uncapped data offers, though most are only “unlimited” during certain days or hours. Fixed broadband data may be uncapped though speeds are usually throttled.

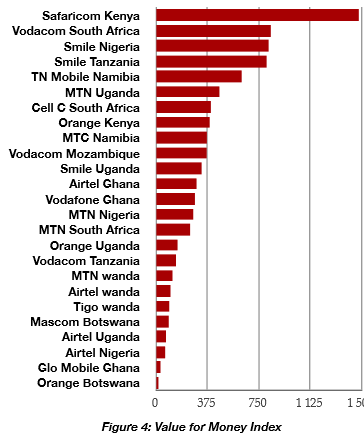

To determine if broadband is actually a good value, RIA created a “Value for Money Index.” The metric examines average download and upload speed in the context of cost, all normalized to the operator’s 1GB basket price. The index is a rough estimate as it relies on Ookla’s network speeds which often only capture the speed between the user and ISP – not between the user and actual websites which are hosted internationally, for example. Still, it is a good baseline and is the best data available.

LTE products actually were priced very similarly across Namibia, Nigeria, South Africa, Tanzania, and Uganda (generally between US$10-15 for 1GB). Actual speeds were not given, however.

Back to the “Value for Money” Index, which is based on the speed per 1GB for ten selected countries:

- Safaricom Kenya leads other African operators by a factor of two

- Vodacom South Africa, Smile Nigeria, and Smile Tanzania have similar balances of speed and cost

- TN Mobile Namibia has high speeds and high cost; therefore it is still a good value (MTC isn’t far behind)

- One reason Smile is so fast in Nigeria and Tanzania is that it offers LTE mostly in urban areas and doesn’t face the same QoS challenges as operators with a larger geographic footprint

- Glo Mobile Ghana has competitive costs but poor speed

- Ranking last on this index is Orange Botswana with moderate costs and poor speed

- Airtel tends to rank in the bottom half, more due to speed than cost

- Uganda, South Africa, Kenya, and Mozambique offer relatively strong value overall

- Rwanda, Botswana, and Tanzania have relatively poor value overall

A similar index based on “per megabyte price” (as opposed to per gigabyte price) yields similar results.

The takeaway is, while it’s important to make broadband access affordable, the reliability of internet products needs to improve. Kenya may have a competitive mobile broadband market but the absence of LTE constricts overall performance. It should be noted that a strong 3G network is better than a weak LTE one.

Research ICT Africa (RIA) monitors broadband prices across 12 African countries every quarter. It does so by establishing the cost of a broadband basket for both fixed and mobile products from all operators in each country under investigation.

Twitter

Twitter Facebook

Facebook Pinterest

Pinterest

[…] A Research ICT Africa policy brief from June 2014 asks the question: “Is broadband data worth the money?” Click here to read entire article […]