Tying African economic growth to potential tech growth

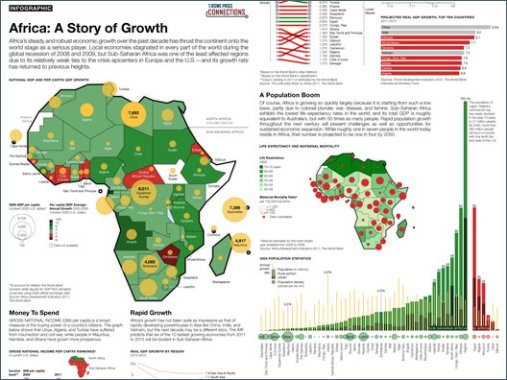

A new infographic by global investment management firm T. Rowe Price has caught our eye. Titled “Africa: A Story of Growth“, the massive PDF highlights key growth factors that suggest many African nations are now serious world players. As the firm points out, Sub-Saharan Africa weathered the global recession of 2008-09 relatively well due to the lack of business ties to Europe and the United States. Still, the authors are just as quick to mention how African growth is starting from a low base. In fact, Sub-Saharan Africa’s GDP is equivalent to Australia – but with 50x as many people.

Often, strong economic growth is tied to an equal level, if not higher, technology growth. Using the inforgraphic (World Bank data), we’ve come up with a few predictions of how Sub-Saharan Africa economic trends could influence tech growth:

- Per capita GDP growth in Equatorial Guinea and in Angola was greater than 10% from 2000-2009. Telecoms growth has generally not matched GDP growth, despite investment in LTE in Angola and the ACE submarine cable in Equatorial Guinea.

- Nine nations saw negative per capita GDP average annual growth. Despite this drop, nations like Cote d’Ivoire, Zimbabwe, Liberia, Togo, and Benin have strong tech communities.

- Gross national income per capita (ie. buying power) rose in the past couple of years in Namibia, Ghana, and Lesotho. Accordingly, the tech scenes in these countries are on the up. GNI per capita decreased the most in North Africa (Libya, Algeria, Tunisia) amid social and political conflict.

- The IMF predicts that six of the 10 fastest growing economies from 2011-2015 will be located in SSA. They are Ethiopia, Mozambique, Tanzania, DRC, Ghana, Zambia, and Nigeria. Large untapped populations play a role as do geographic locations and political stability. Be sure to watch the Internet industries in each of these nations (Mozambique is rather intriguing).

- 3-4% annual population growth rates in The Gambia, Liberia, Benin, Niger, Burkina Faso, and Uganda could drive innovation.

- Gabon is nearly all urban – a benefit to mobile Internet coverage.

- Mobile subscriptions per 100 people data is from 2009 so should be taken with a grain of salt.

- Foreign Direct Investment remains high in Egypt, Nigeria, Congo (Dem. Rep.), Congo (Rep.), Ghana, and Algeria.

- Development assistance and official aid received by Tanzania, Sudan, and Mozambique remain high on a per capita basis.

The infographic, part of T. Rowe Price’s commitment to finding opportunity in the global economy, was produced in part with Infographics.com.

Twitter

Twitter Facebook

Facebook Pinterest

Pinterest